|

||||||

|

||||||

|

||||||

|

| [uk_rpi] [tentative_conclusions] |

|

Current gilts-based inflationary expectations just haven't been working well. They have mostly tended to be biased too high, with the converse in recent years. The standard approach is mandatory for PPF calculations (which are meant to be “prudent”) and merely recommended for FRS17 (or IAS19) calculations (which are intended to be “realistic”). This has led to continuing significant corporate accounting distortions and we think this matters. Broadly, deferred liabilities are being overstated by at least 25% and possibly substantially more than that. One point which should be taken into account much more often is that prudence can only be assessed against a best estimate. If the current general approach is hardly “best estimate”, it is hard to see how it can possibly be taken as prudent. We suspect it is actually “super-prudent”, directly leading to huge capital and social losses, in the form of wildly inflated deficit payments inflicted upon business stakeholders and losses of valuable pension rights by a huge number of employees.

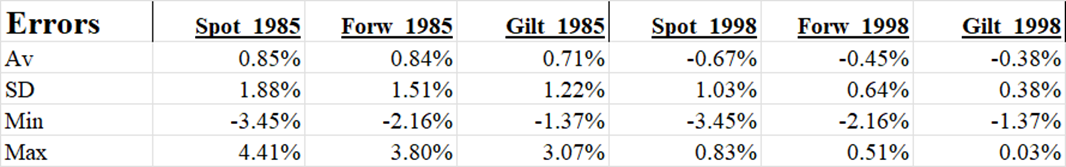

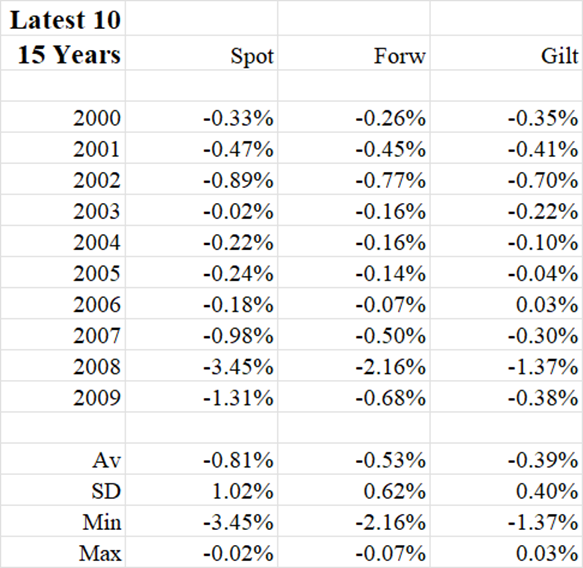

Unlike previous years, since 1998 and since 1985, gilt-based estimates have actually been marginally better, rather than worse, than the forward or spot alternatives. While all three measures have overstated inflation by around 1% (mean) since 1985, the gilts approach is not the worst; nor has it varied by as much as the others. However, the period covered is very short (around one-half of the data) and we should not discard pre-1998 data. Looking at the last 10 periods of 15 years, we have the following table of errors by start year.

For 2003-2018 through 2006-2021, all three measures converged to within 0.25% but that was not the case for 2007-2022, 2008-2023 or 2009-2024, the latest 3 periods for which we have data. We can’t assume that the results until 2024 (or any other year) are truly indicative. Despite the data above, we still believe that the normal approach without any adjustments is flawed so we need to fix an adjustment. While gilts were marginally “best” since 1998, we don’t think it right to discard the earlier experience, especially since we’ve not yet seen the full impact of the financial crisis coming through. So, looking back to 1985 (see first table above), we still think it appropriate to start from “forward”, deducting 1% pa, as previously suggested. When RPI is replaced by CPIH for ILG payments, that will make the common approach even less justifiable but we would increase the deduction by 0.7% pa to 1.7% pa. |